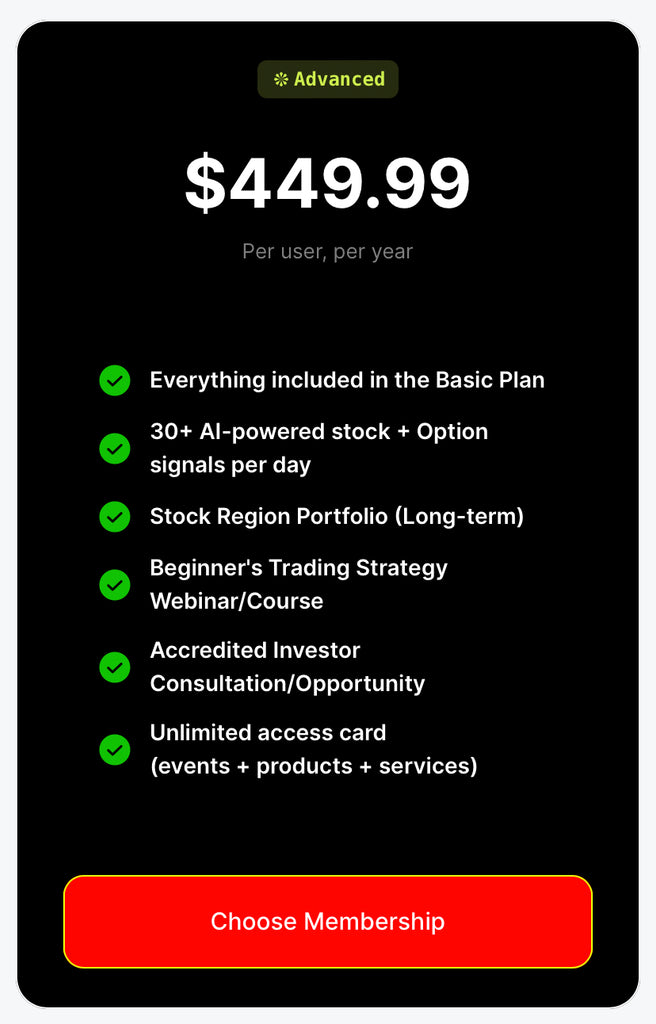

Advanced Stock Region Membership

$422.03

This membership is good for beginner or experienced people who prefer to invest long-term and trade short-term.

*Yearly access. Check your email for an immediate invite to our Telegram and Discord network during operating hours. Please allow up to 5 minutes to receive an invite via email during after-hours.

Telegram & Discord is are applications where members receive notifications of our signals and can communicate with other members of the private trading network through text, video chat or phone call.

Operating Hours:

Mon - Friday: 9:00 AM-5:00 PM

We’re here with you through a volatile stock market. Whether you’re a full-time day trader or entirely new to the stock market, our daily stock market sentiments and alerts are designed to benefit all skill levels and portfolio sizes.

These daily alerts help you identify exactly when to buy and sell stocks using our pivot-points, price targets, stop-losses and zones when trading shares or contracts.

Tap Here To Purchase Mentorship/Course

Tap Here To Book Free Guidance Zoom Meetings

Common Definitions:

Uptrend Zone means: The stock price most likely wants to go up after a certain price.

Downtrend Zone means: The stock price most likely wants to go down after a certain price.

Pivot means: An important price level to a trader, like an inflection point, where they expect price to either continue in the current direction or reverse course.

Volume Spike means: Unusually large volume, graphed on a bar chart as a spike.

Testing Rebound means: A day or a period of time in which a stock, or the stock market overall, recovers after a selloff.

Parabolic Movement means: When a stock makes an upward price move that looks like the right side of a parabolic curve.

Continuation means: An indication that the price of a stock or other asset will continue to move in the same direction even after the continuation pattern completes.

Volatility means: The rate at which the price of a stock increases or decreases over a particular period.

Bullish means: A bullish person that acts with a belief that prices will rise in the present or future.

Bearish means: A bearish person that acts with a belief that prices will fall in the present of future.

Market Cap means: The total value of a publicly traded company's outstanding common shares owned by stockholders.

Catalyst means: Anything that precipitates a drastic change in a stock's current price trend.

Trading Options means: The practice of buying or selling options contracts

Contract means: Each contract represents 100 shares of the underlying stock. the buyer will promise to buy an asset at a later date and at a certain price. Similarly, the seller will be needed to provide the asset at the agreed price.

Shares mean: The units of the ownership of a company, usually traded on the stock market or equity ownership in a corporation or financial asset, owned by investors who exchange capital in return for these units.

Stop Loss means: An order placed with a broker to buy or sell a specific stock once the stock reaches a certain price or an advance order to sell an asset when it reaches a particular price point.

Alert means: In trading, an alert is a message that indicates a potential trading opportunity. Alerts can be generated by technical indicators or fundamental news events.

Day trading means: Buying and selling shares on the stock exchange on the same day are known as Intraday trading. As buying and selling happen on the same day, it is also known as day trading. The prices of shares keep moving up and down during the day, the trader makes a profit from the movement of the share price.

Swing trading means: A style of trading that attempts to capture short- to medium-term gains in a stock (or any financial instrument) over a period of a few days to several weeks.

Long term means: A trading style in which the trader will hold on to a position for an extended period of time. A position trade can last anywhere from a few weeks to a couple of years.

Short term means: A strategy that aims to open and close positions within a short timeframe, usually days or weeks, although it can be even shorter.

Visit company directory at https://stockregion.com or Submit a question.

Founded by Entrepreneur, Jonathan Felix, a young and ambitious stock market enthusiast who loves connecting hundreds of like-minded individuals to one network every day in an effort to achieve his goal of building software and developments that give back to the people, foundations and organizations region-wide. Stock Region was established in 2020 during the infamous coronavirus pandemic. Well known for alerting popular stocks such as GameStop under $14, and cryptocurrencies like Dogecoin under half-a-penny. People everywhere continue to benefit from this American-based network of beginner and veteran investors, where people exchange trading strategies, ideas, and discover elite opportunities together by playing both sides of the stock market.

The Stock Region Trading Network is an innovative service that sends lighting fast stock market signals straight to your phone every day. Incorporate this in your trading routine, short term and long term, a foreshore way to stay on top of the market, early.

Members even benefit outside of the market as a partner. That’s right. Being a Stock Region ambassador means obtaining unlimited access to the network, free merchandise and much more to come.

People can’t wait to experience the Stock Region mobile app. Never seen before scanners, marketplaces, live trading rooms, podcasts, leaderboards and much more.

The mission is simple: To create awesome programs and technology that help people trade better together while supporting local to global organizations that make this world a better place.

Find out for yourself. Stock Region is building a prestige community of people who want to excel our great economy and in life, together.

Stock Region is the worldwide source for stock market updates, daily alerts and educational courses online to a network of traders or investors.

The Stock Region investing network provides a number of benefits for its members, including access to exclusive research and tips from experienced investors, and a forum to share ideas and discuss strategies. For novice investors, our community can be a valuable resource for learning the ropes. For more experienced investors, the Stock Region community can be a great way to stay abreast of new developments and find new opportunities. In either case, our investing community can be a valuable tool for anyone looking to improve their investment strategy. Here are some of the benefits that an investing community can offer:

1) Access to exclusive research:

Many investing communities offer their members exclusive access to research and analysis that is not available to the general public. Stock Region research can give investors an edge in making informed investment decisions.

2) Tips and insights from experienced investors:

Experienced investors can offer valuable tips and insights to members of an investing community. Using Stock Region as a source of information can be helpful for both novice and experienced investors.

3) A forum to share ideas and discuss strategies:

An investing community can provide a forum for members to share ideas and discuss investment strategies. The Stock Region Network can be a valuable resource for investors looking to improve their investment strategies.

4) Access to new opportunities:

Creating relationships with other investors is a great way to stay abreast of new investment opportunities. This can be especially helpful for experienced investors who are always on the lookout for new investments in the market.

5) A sense of camaraderie:

Trading together offers a sense of camaraderie among its members. Stock Region can be a valuable benefit for investors who may feel isolated in their investment activities.

6) A source of motivation:

A great source of motivation for its members. This can be helpful for investors who need a little extra motivation to stay focused on their investment goals.

7) A sounding board for new ideas:

Getting opinions from a trading community provides a sounding board for new investment ideas. Stock Region is a valuable resource for investors who are looking for feedback on their investment ideas.

8) A place to learn:

Learning from a network of successful mentors is a great place to learn about investing. This can be especially helpful for new investors who are curious to learn.

9) A place to network:

Experience is a great teacher. An investing community can be a great place to network with other veteran and beginner investors.

10) A source of support:

Connecting with people who love to invest can be a great source of support for its members. This is helpful for investors who need a little extra support to stay on track with their investment goals.

No matter what your level of experience, an investing community is a valuable resource long term. If you are looking to improve your investment strategy, the Stock Region investing community offers a network of benefits that help you reach major goals while giving back to impactful charities and organizations just by using our products or services.

In the past decade, high-speed trading has come to dominate the stock market. But what exactly is high-speed trading? And why do stock traders need a trading network?

High-speed trading is a type of trading that uses computer algorithms to trade stocks in milliseconds. This type of trading has become very popular because it allows traders to make a lot of money in a short amount of time.

However, there are a few reasons why stock traders need a trading network. First, it allows traders to connect to multiple exchanges. This is important because it allows traders to buy and sell stocks on different exchanges. Second, certain services and technology provides data feeds to traders. This is important because it allows traders to see what is happening in the market and make informed decisions. Third, a trading network provides order execution. Allowing traders to execute their trades quickly and efficiently. Fourth, a trading network provides risk management. This is important because it helps traders to manage risk and protect their capital. Finally, a trading network provides access to capital. This is important because it allows traders to access the capital, they need to trade stocks.

If you are a stock trader, then you should definitely consider using a trading network. You’ll be provided with the tools you need to be successful in the stock market.

A trading network gives stock traders the ability to connect with other traders and share information.

This can be extremely helpful when it comes to making decisions about trades. Here are five reasons why stock traders need a trading network:

1. Gives stock traders the ability to connect with other traders and share information.

2. Helps stock traders find trading opportunities that they may not have otherwise known about from the public.

3. Stock traders learn from each other. Learning from other member’s failures and successes provides leverage when trading in the market.

4. Investors stay up to date on market news and events. Being surrounded by individuals who are constantly exchanging research material makes trading easier.

5. A trading network helps stock traders save time and money by providing a convenient way to trade stocks.

A trading network provides stock traders with real-time market data.

In order to make informed decisions when trading stocks, stock traders need to have access to real-time market data. Stock traders have access to the data they need to make informed decisions about when to buy and sell stocks. Trading networks provide stock traders with access to research and analysis tools that help them make more informed decisions about which stocks to trade. Stock traders have access to trading platforms that allow them to execute trades quickly and efficiently. Finally, trading networks provide stock traders with access to customer service, mentors, and support in case they need assistance with their trading concerns or have questions about the markets.

A trading network offers stock traders the ability to trade directly with other traders.

A trading network offers access to a variety of resources that can help them make informed decisions about their trades. Stock traders have the ability to connect with other traders who may have information that can help them make better trades. In addition, stock traders have the ability to access a variety of tools and resources that help them improve the performance of their portfolios and make informed decisions about their trades. Finally, stock traders have the ability to connect with other traders who may be able to provide them with wisdom and guidance.

A trading network helps stock traders find new trading opportunities.

With a trading network, stock traders connect with other traders to share information and ideas. Investors find new trading opportunities with the help of a community. Stay up-to-date on market news and events without the spending so many hours researching.

A trading network provides stock traders with the ability to track their portfolios.

Stock traders have the ability to track their portfolios, receive real-time quotes, and execute trades. A trading network offers news and analysis, as well as access to brokers and other services. A valuable resource for stock traders, providing them with the ability to stay informed and make informed decisions. So, what are you waiting for? Get started with Stock Region today.